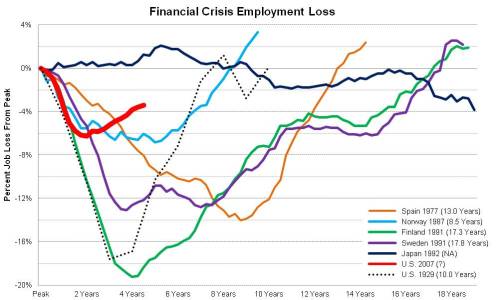

UPDATE: The following graph is an update with U.S. employment data through November 2013. The remainder of the post is as previously published in September, 2012.

Seeing that it has been a year since the update to Carmen Reinhart and Kenneth Rogoff’s great work on financial crises, I thought it would be a good idea to check in on how the U.S. is doing relative to these other historical crises.

First, the Great Recession is the clearly the worst post-World War II business cycle in the U.S. as evident by comparing job losses.

However, when the Great Recession is compared not to other U.S. cycles but to the Big 5 financial crises and the U.S. Great Depression (thanks to U.S. Treasury for adding that to the graph), the current cycle actually compares pretty favorably. This is likely due to the coordinated global response to the immediate crises in late 2008 and early 2009. While the initial path of both the global and U.S. economies in 2008 and 2009 effectively matched the early years of the Great Depression – or worse – the strong policy response employed by nearly all major economies – both monetary and fiscal – helped stop the economic free fall.

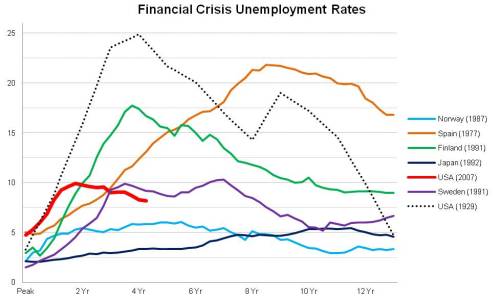

Finally, the last graph is a new one and compares unemployment rates across these same crises. While the current U.S. cycle rate effectively doubled from 4.5% to 10.0%, many other crises’ gains were even larger. In fact, the percentage increase, as opposed to percentage point increase, in the unemployment rate for all crises except Japan were larger than the U.S. Great Recession. Even Norway’s unemployment rate which topped out at just over 6% represented a near tripling of the pre-crisis rate of 2.1%. Note that the unemployment rate peak used here is the 12 month average preceding each crisis.

For the full comparison please see the previous post which details housing prices, equity prices, real GDP and government debt.

[…] 24, 2012 by Mark Thoma Tim Duy: Excuses Not To Do More, by Tim Duy: Josh Lehner (via CR) reviews some of his earlier work on the Reinhart and […]

By: Fed Watch: Excuses Not To Do More | The Penn Ave Post on September 24, 2012

at 12:07 PM

Josh, will you please do similar graphs for economic equality/inequality, and for wages for all persons below the 90th percentile — in other words, for what most citizens were experiencing? Perhaps Obama’s performance wasn’t so good after all.

By: Eric on November 15, 2012

at 12:32 PM

Thanks Eric. Unfortunately I do not have good data on the topics you list for cross-country comparisons, or historical comparisons. I do have a research report in the pipeline for Oregon-specific labor market changes regarding job polarization (job growth in high skill and low skill positions, but shrinking opportunities for middle skill jobs). MIT professor David Autor is the leading national researcher on job polarization and what is termed skill-biased technological change and has written numerous academic papers and few more accessible reports on the subject. Also the Federal Reserve Bank of New York has published a few research notes within the past year on job polarization, which was the basis for my upcoming work.

It has certainly been a very rough business cycle for nearly all industries and occupations. Job gains have been slow and wage gains even slower, from a historical point of view. One issue with this line of research is the occupational data is less timely. We get detailed industry employment data every single month, however some of the occupational data, particularly at the state or local level, is only once per year. Occupations matter for the inequality and polarization research because examining industries or firms masks even their underlying dynamics. Take a large manufacturing firm as a hypothetical example. Besides having engineers, line/assembly workers and other numerous manufacturing/production employees, the company also has executives, accountants, media relations, admin support, janitors and the like. It is better to examine wages and trends across each of the occupations then to examine the trends across industries, if that makes sense.

By: Josh Lehner on November 15, 2012

at 1:12 PM

[…] Not To Do More, by Tim Duy: Josh Lehner (via CR) reviews some of his earlier work on the Reinhart and Rogoff results and […]

By: Economist's View: Fed Watch: Excuses Not To Do More on September 24, 2012

at 1:07 PM

[…] where this excellent chart (first stopped) from Oregon economist Josh Lehner and NPR’s Planet Money comes […]

By: IT’S FINALLY BEEN SETTLED: The US Bank Bailout Was Amazing, And The Swedish Model Was A Total Joke « Money & Business on September 24, 2012

at 3:21 PM

[…] where this excellent chart (first stopped) from Oregon economist Josh Lehner and NPR’s Planet Money comes […]

By: 2251 Wall St » IT'S FINALLY BEEN SETTLED: The US Bank Bailout Was Amazing, And The Swedish Model Was Devastating on September 24, 2012

at 4:41 PM

[…] Duy comments on this Josh Lehner piece comparing the current recovery to past recoveries from financial crises. Duy notes that […]

By: Footnotes « Negative Interest on September 24, 2012

at 4:50 PM

[…] where this excellent chart (first stopped) from Oregon economist Josh Lehner and NPR’s Planet Money comes […]

By: IT’S FINALLY BEEN SETTLED: The US Bank Bailout Was Amazing, And The Swedish Model Was Devastating | Athens Report - Top Stories on September 24, 2012

at 5:00 PM

[…] where this excellent chart (first stopped) from Oregon economist Josh Lehner and NPR’s Planet Money comes […]

By: IT’S FINALLY BEEN SETTLED: The US Bank Bailout Was Amazing, And The Swedish Model Was Devastating | on September 24, 2012

at 5:38 PM

Can you add Iceland to your charts? They took a radically different approach to the banks and I’d like to see how they stack up.

By: TWPolk on September 24, 2012

at 6:38 PM

[…] where this excellent chart (first stopped) from Oregon economist Josh Lehner and NPR’s Planet Money comes […]

By: IT'S FINALLY BEEN SETTLED: The US Bank Bailout Was Amazing, And The Swedish Model Was Devastating | ccnew on September 24, 2012

at 10:33 PM

[…] last longer and often are deeper in their adverse effects on the economy. Given this fact Lehner examines how the U.S. financially induced recession compares with other recessions in the U.S. and other […]

By: Financial Crises Recoveries: The Good-Bad-Mixed News | Decisions Based on Evidence on September 25, 2012

at 4:05 AM

[…] Been Worse Josh Lehner does something I’ve been meaning to do: he compares US economic performance since the financial […]

By: Coulda Been Worse - NYTimes.com on September 25, 2012

at 5:37 AM

[…] chart above was put together by Josh Lehner, an economist for the state of Oregon. The red line shows the […]

By: Economix Blog: Comparing the Job Losses in Financial Crises | globalgoals on September 25, 2012

at 8:10 AM

[…] chart above was put together by Josh Lehner, an economist for a state of Oregon. The red line shows a change in […]

By: Economix Blog: Comparing the Job Losses in Financial Crises | News Fringe on September 25, 2012

at 8:21 AM

[…] scariest chart ever,” Josh Lerner uses the Reinhart-Rogoff analysis of financial crises to generate a new chart, comparing the unemployment rate to those from other incidents of this type. Lerner considers this […]

By: The Wrongheaded Bailout Defense By Comparing to Other Financial Crises | OccuWorld on September 25, 2012

at 9:37 AM

[…] gave a speech in Washington Sept. 24 with one main point: Policy matters. The above graph, from Josh Lehner, is an example of why: It shows how long jobs took to recover from seven global financial crises. […]

By: Quartz on September 25, 2012

at 10:08 AM

[…] Posted on September 25, 2012 by Toca do Javali Coulda Been Worse, by Paul Krugman, in NY Times: Josh Lehner does something I’ve been meaning to do: he compares US economic performance since the financial […]

By: Paul Krugman: Coulda Been Worse | MG-PT on September 25, 2012

at 10:11 AM

[…] The recession was unlike any other during the post-war period — an era notably free of financial crises in the U.S.. And when you compare the current jobs picture with what happened during and after other financial crises around the world, it looks, if not good, then at least less bad. Enlarge Oregon Office of Economic Analysis […]

By: It Could Be Worse (Unemployment Edition) : Planet Money : NPR on September 25, 2012

at 11:25 AM

[…] the unemployment rate and economic growth was significantly less. That gets us back to Lehner’s employment chart, which is also at the top of this […]

By: Does this graph prove the bailout and the stimulus worked?|Politifreak on September 25, 2012

at 11:35 AM

[…] unemployment rate and economic growth was significantly less. That gets us back to Lehner’s employment chart, which is also at the top of this […]

By: Does this graph prove the bailout and the stimulus worked? on September 25, 2012

at 12:05 PM

[…] chart above was put together by Josh Lehner, an economist for the state of Oregon. The red line shows the […]

By: Comparing the Job Losses in Financial Crises | Forex Market Today on September 25, 2012

at 1:02 PM

[…] Source […]

By: "when the Great Recession is compared not to other U.S. cycles but to the Big 5 financial crises and the U.S. Great Depression, the current cycle actually compares pretty favorably." « Economics Info on September 25, 2012

at 2:00 PM

[…] addthis_share = {"templates":{"twitter":"Lux et Veritas: {{title}} {{url}} (via @jessefrederik)"}};}Josh Lehner heeft een aardige blogpost waarin hij verschillende financiële crises in verschillende landen en […]

By: Crisis, arbeid en de jaren dertig: waarom ‘verloren decennia’ niet nodig zijn | Lux et Veritas on September 25, 2012

at 11:54 PM

[…] El artículo que tiene esta gráfica con el análisis correspondiente lo pueden encontrar en https://oregoneconomicanalysis.wordpress.com/2012/09/24/checking-in-on-financial-crises-recoveries/ […]

By: Mal de muchos, consuelo de tontos - MacroAnalit on September 26, 2012

at 3:50 AM

[…] We’re #1 Posted on September 26, 2012 by reflectionephemeral … at weathering financial crises, from an unemployment perspective, except Japan whose atypical structure and subsequent experience no one would want to emulate. Sounds like a good Obama 2012 slogan! From Josh Lehner: […]

By: We’re #1 | Poison Your Mind on September 26, 2012

at 5:16 AM

Thank you, Very interesting data, seems compelling. What are the long term consequences of all the QE?

By: mark krebs on September 26, 2012

at 7:12 AM

[…] on Checking In on Financial Crisis Recoveries for the source of the chart in a report by Josh Lehner of the Oregon Office of Economic Analysis. […]

By: Benchmarking the U.S. employment recovery « Phil Ebersole's Blog on September 26, 2012

at 3:44 PM

Mr. Lehner, what was the date of the peak point chosen for the 2001 crisis? It appears that looking at the unemployment rates for the US for that crisis and the current one, we’re now recovering at a much greater rate, especially if as you mentioned we start from the point of peak job loss. http://bit.ly/P4YYLd

By: Ravi Mikkelsen on September 26, 2012

at 6:40 PM

[…] Not To Do More, by Tim Duy: Josh Lehner (via CR) reviews some of his earlier work on the Reinhart and Rogoff results and […]

By: Fed Watch: Excuses Not To Do More | FavStocks on September 27, 2012

at 1:18 AM

[…] is what Josh Lehner says: The question that naturally follows and is not answered here is why does the current U.S. cycle […]

By: Visually Comparing GDP And Unemployment Post Financial Crisis, US Vs Eurozone on September 27, 2012

at 3:22 PM

[…] some evidence to back the idea up. Josh Lehner of the Oregon Office of Economic Analysis has a great post up on his blog that looks at US job losses in comparison to other financial crises (a opposed to […]

By: To Journey through time or space?? | Brucetheeconomist's Blog on September 28, 2012

at 9:23 PM

[…] Josh Lehner does something I’ve been meaning to do: he compares US economic performance since the financial crisis with other episodes of major financial crisis. And guess what? We actually look better than most (sorry about the small print): […]

By: Coulda Been Worse | Get Money Out Of Politics on September 29, 2012

at 7:44 PM

[…] –Crisis Comparison: Josh Lehner compares the Great Recession in the U.S. with other major crises across the world. “However, when the Great Recession is compared not to other U.S. cycles but to the Big 5 financial crises and the U.S. Great Depression (thanks to U.S. Treasury for adding that to the graph), the current cycle actually compares pretty favorably. This is likely due to the coordinated global response to the immediate crises in late 2008 and early 2009. While the initial path of both the global and U.S. economies in 2008 and 2009 effectively matched the early years of the Great Depression – or worse – the strong policy response employed by nearly all major economies – both monetary and fiscal – helped stop the economic free fall.” […]

By: Secondary Sources: Crisis Comparisons, Safety Zone, Econotrolls - Real Time Economics - WSJ on October 1, 2012

at 9:30 PM

[…] Naked Capitalism. Originally published at Corrente.On September 24, 2012, Josh Lehner published a post comparing employment (jobs) and unemployment rates in and after various financial crises, including […]

By: The Data Don’t Support That The U.S. Bank Bailouts Were Better Than the Swedish Model « naked capitalism on October 2, 2012

at 8:27 PM

[…] But graphs shown in a recent post created by state of Oregon economist Josh Lehner show that in comparison to past U.S. financial crises and those that took place in other countries, the 2007 U.S. recession isn’t and/or wasn’t as bad as it could have been. […]

By: Job losses during historic and current financial crises on October 2, 2012

at 9:09 PM

[…] you are a chart-aficionado like me, then you’ll love Josh Lehner’s article showing how the Great Recession (or The Lesser Depression) compares with other recessions in the US […]

By: How does this Recession Compare to other Recessions? | Green Star Advisors on October 3, 2012

at 9:11 AM

What do you use to draw your wonderfull graphs.

By: sbanicki on October 7, 2012

at 8:02 PM

Thanks; I use both Microsoft Excel and PowerPoint to produce all my material.

By: Josh Lehner on October 24, 2012

at 8:18 AM

[…] And here’s how our recovery stacks up against other recoveries from financial crises, from Josh Lehner: […]

By: The Causes Of Our Current And Projected Deficits And Debt | Poison Your Mind on October 16, 2012

at 7:40 AM

[…] states about the preliminary employment benchmark data and I’ve been asked to present the financial crises update work to the broader conference audience as well. Following the conference, we have our regular forecast […]

By: What OEA is up to these days « Oregon Office of Economic Analysis on October 18, 2012

at 2:22 PM

[…] UPDATE: The information below was originally published Sep 2011; an update is available here. […]

By: This Time is Different, An Update « Oregon Office of Economic Analysis on November 13, 2012

at 2:18 PM

[…] Oregon economist Josh Lehner made this chart comparing the employment trajectory of the US recovery vs. other financial crises in recent history. […]

By: The US Recovery Has Been Astounding — And Now Here Comes Its Final Huge Test | Blog Feeds on November 14, 2012

at 5:00 AM

[…] Josh Lehner […]

By: Alan Greenspan's Comments About The Fiscal Cliff Are Horribly Misleading And Making The Crisis Worse | Jo WeberJo Weber on November 16, 2012

at 10:20 AM

[…] points us to Ryan Avent and Josh Lehner, both showing in different ways the better post-recession outcomes experienced by the US compared […]

By: Economist's View: Fed Watch: Fiscal Madness on November 19, 2012

at 12:23 AM

[…] points us to Ryan Avent and Josh Lehner, both showing in different ways the better post-recession outcomes experienced by the US compared […]

By: November 23, 2012 « PrefBlog on November 23, 2012

at 8:58 PM

[…] Via Oregon: […]

By: Maybe not so bad? - The Skewered Truth on November 25, 2012

at 8:40 PM

[…] chart above was put together by Josh Lehner, an economist for the state of Oregon. The red line shows the […]

By: Comparing the Job Losses in Financial Crises – | LOGZ Logística Brasil S.A. on December 3, 2012

at 8:16 AM

[…] for example the UK, have fallen for. Some of you may prefer to see this in pictures: "…when the Great Recession is compared not to other U.S. cycles but to the Big 5 financial crises and the U.S. Great […]

By: Obama Economy - The Fed Knows Just How Bad It Will Be - Page 3 on December 16, 2012

at 11:11 AM

[…] together at the Oregon Office of Economic Analysis (an article providing background to the chart is here). The chart shows the hard road to recovery after a financial crisis; but the main point is that […]

By: All Change for Employment? | The Rational Pessimist (formerly Climate and Risk) on January 5, 2013

at 4:11 PM

[…] at the Oregon Office of Economic Analysis (an article providing background to the chart is here). The chart (click for larger image) shows the hard road to recovery after a financial crisis; but […]

By: All Change for Employment? | The Rational Pessimist on January 6, 2013

at 8:13 AM

[…] Da chart comez from Oregon economis' Josh Lehna, an' az you can see, da US haz had a remarkable jobz comeback compare' ta almos' every otha financial criziz. Despite da weak economy, da re' line (da US jobz recovery) haz gone fasta den jus' about any otha country’z comeback […]

By: Tim Geithner’s Amazing Legacy In One Chart | New Yerk Times on January 10, 2013

at 11:03 AM

[…] The chart comes from Oregon economist Josh Lehner, and as you can see, the US has had a remarkable jobs comeback compared to almost every other financial crisis. Despite the weak economy, the red line (the US jobs recovery) has gone faster than just about any other country’s comeback […]

By: Tim Geithner’s Amazing Legacy In One Chart | ImpressiveNews on January 10, 2013

at 11:21 AM

[…] Da chart comez from Oregon economis' Josh Lehna, an' az you can see, da US haz had a remarkable jobz comeback compare' ta almos' every otha financial criziz. Despite da weak economy, da re' line (da US jobz recovery) haz gone fasta den jus' about any otha country’z comeback […]

By: Tim Geithner’s Amazing Legacy In One Chart | The Las Angeles Times on January 10, 2013

at 12:09 PM

[…] Weisenthal pulls a chart from the Oregon Office of Economic Analysis that puts Geithner’s tenure in perspective: compared to previous financial crises — and […]

By: The Tim Geithner Legacy Project | Felix Salmon on January 10, 2013

at 2:57 PM

Good Information. Thank you for sharing and I want to share information about Gerstein Fisher which is an independent investment advisory firm that manages assets on behalf of individuals and families and helps clients with their financial goals.

By: Davis on January 14, 2013

at 9:08 PM

[…] September 24, 2012, Josh Lehner published a post comparing employment (jobs) and unemployment rates in and after various financial crises, including […]

By: The Data Don’t Support That The U.S. Bank Bailouts Were Better Than the Swedish Model « naked capitalism on April 9, 2013

at 12:22 AM

There’s definately a lot to know about this subject. I love all the points you have made.

By: Rachaels Printable Daily Coupons on April 10, 2013

at 2:52 AM

Hi to every body, it’s my first go to see of this website; this website consists of amazing and truly good data in support of readers.

By: Paula on July 24, 2013

at 9:05 AM

[…] Depression). Check out Ms Rampell’s post for more or read our previous posts (2011 original, 2012 update) for much more detail on comparing these […]

By: Graph of the Day | Oregon Office of Economic Analysis on December 6, 2013

at 12:15 PM

[…] The information below was originally published September, 2011; an update was done in September, 2012 and the latest employment graph (data through November 2013) is […]

By: This Time is Different, An Update | Oregon Office of Economic Analysis on December 6, 2013

at 12:20 PM

[…] Rampell, economics reporter, The New York Times: The chart above is an updated version of one that Joshua Lehner, an economist at the Oregon Office of Economic Analysis, posted last year. As […]

By: The Most Important Economic Stories of 2013—in 37 Graphs on December 10, 2013

at 2:30 PM

[…] With the December jobs report, another year is in the books for Oregon’s economy. Preliminary estimates show December was another big month (more on that in a minute) but for the year overall, 2014 was actually quite strong. 43,500 jobs on an annual average basis for a growth rate of 2.6%. Both of which are the strongest since 2006. However, more importantly, progress continues to be made across the broader measures of the labor market, see the Economic Recovery Scorecard. While Oregon’s economy, number of jobs and the like have never been larger, we know that the economy is still not fully healed some 7 years after the onset of the Great Recession (primarily due to it being a financial crisis.) […]

By: Oregon Employment, December 2014 | Oregon Office of Economic Analysis on January 21, 2015

at 10:48 AM